My Condominium Association's Financial Information

Accurate annual budgets assure sufficient income to meet projected expenses. Monthly financial reporting provides tracking of expenses against budget. A published financial policy helps assure compliance with best accounting practices.

Accurate annual budgets assure sufficient income to meet projected expenses. Monthly financial reporting provides tracking of expenses against budget. A published financial policy helps assure compliance with best accounting practices.

My Condominium Association's maintenance fees cover many of the basic costs associated with home ownership.

Association fees pay the cable TV, Internet, water, sewage, trash collection, master insurance, landscaping, pest control, security, fire protection, and property management/maintenance bills. A portion of the fees are set aside and invested as reserve funds for financial protection against the cost of major common replacement items -- concrete restoration, general restoration (pools, lake bridge & waterfall), elevators, building painting, roof replacement, parking lot paving, and irrigation systems. Maintenance fees pay the salaries of a property manager, office staff employees, and maintenance employees.

Following is important financial information for My Condominium Association unit owners:

Financial ReportsFinancial Reports, published monthly, contain 8 sections:

Click on the links in the adjacent columns to view our Financial Reports. |

Last Year's Financial Reports | Current Year Financial Reports |

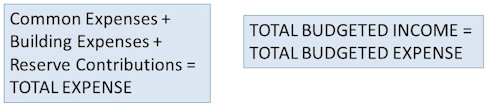

Annual BudgetThe Annual Budget for a multicondominium association contain 4 components:

Click on the links in the adjacent column to view these budget components. |

Current Year Budget |

|

My Condo Community Budget Summary 2021 |

Audited Financial StatementsPer Florida Statute 718.111(13), condominium associations with total annual revenue of $500,000 or more must prepare audited financial statements. Within 90 days after the end of the fiscal year, or annually on a date provided in the bylaws, the association shall prepare and complete, or contract for the preparation and completion of, a financial report for the preceding fiscal year. Within 21 days after the final financial report is completed by the association or received from the third party, but not later than 120 days after the end of the fiscal year or other date as provided in the bylaws, the association shall mail to each unit owner at the address last furnished to the association by the unit owner, or hand deliver to each unit owner, a copy of the most recent financial report or a notice that a copy of the most recent financial report will be mailed or hand delivered to the unit owner, without charge, within 5 business days after receipt of a written request from the unit owner. Click on the link in the adjacent column to view part of our Annual Auditor Report of the Association's financial condition. |

Prior Year Audited Financial Statements |

| Audited Financial Statements 2020 |

Financial PolicyAll condominium associations should have detailed published Financial Policy. The Association's Financial Policy Document contains 27 sections of information regarding management and control of the Association's financials. It helps assure financial transparency and optimal use of financial resources. The adjacent column shows the Table of Contents for this document.

|

Financial Policy Document |

| Financial Policy |

Budgeting Process

The annual budget is prepared through the following process:

Preparation

- Obtain year-to-date expense information.

- Project full-year expenses for Operating & Reserve Accounts.

Committee Tasks

- Review each Operating Account and determine percent or dollar increase/decrease for budget year.

- Review each common and building Reserve Account for Years of Life & Replacement Value. Determine contributions needed in budget year to meet expected replacement costs.

- Determine expense variations among buildings (P&L by Class).

- Examine resultant (calculated) maintenance fee structure for reasonableness.

- Make budget adjustments as required.

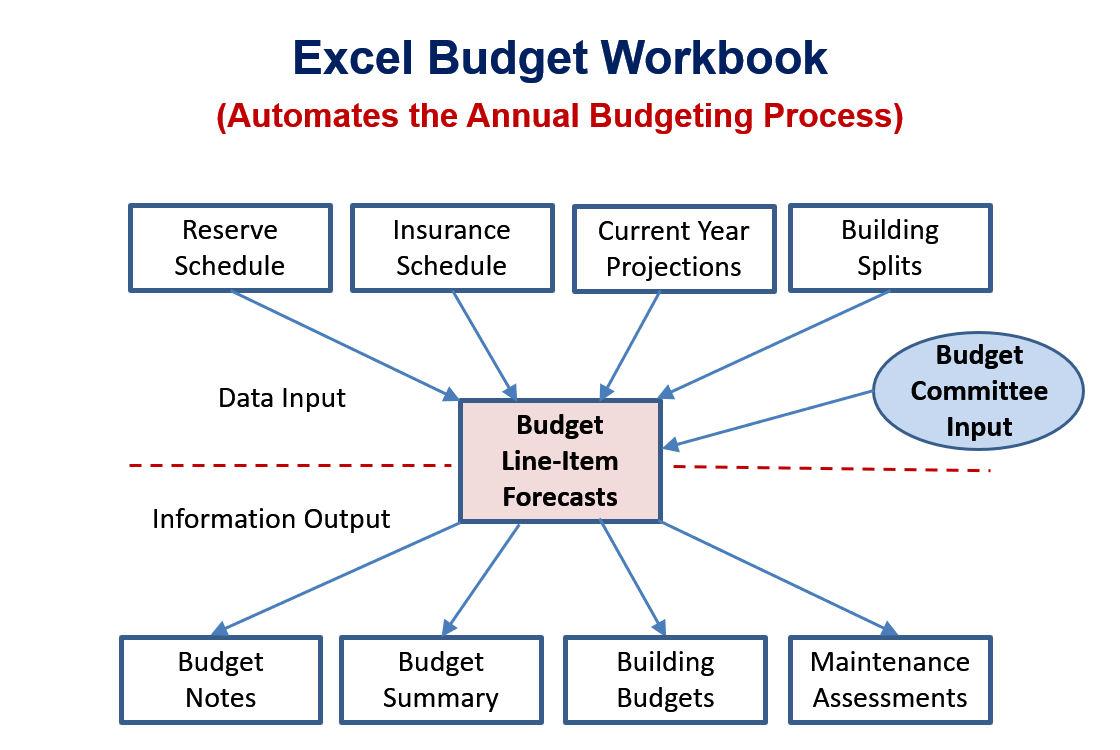

Automating the Budget Process

Preparation of the Annual Budget can be simplified, with changes reflected instantly, through use of a series of interlinked Excel spreadsheets. This process uses historical information, such as the current reserve schedule, data collected from insurance vendors, and 9 months of current-year expenses and combines it with Budget Committee input to produce all of the spreadsheets for the next year's budget. Quarterly Assessments are calculated automatically as a byproduct of the budgeting process, allowing various "what-if" line-item change scenarios.

The Budget Committee uses comparison data, provided by the Budget Workbook, for each line item showing last year's budget figure and current year expense projection to enable them to see and respond to changes and trends.

Commingling of Funds

Commingling is when funds (cash) are mixed between Operating and Reserve investment accounts and among condominiums in a multicondominium community. Florida statutes allow commingling of cash within certain restrictions. However, the Association’s books must accurately reflect at all times the exact funds in the reserve and operating accounts.

Florida Statute 718.111 (14) establishes commingling rules as follows:

- For investment purposes only, reserve funds may be commingled with operating funds of the association.

- Commingled operating and reserve funds shall be accounted for separately, and a commingled account shall not, at any time, be less than the amount identified as reserve funds.

- A multicondominium association is not prohibited from commingling: the operating funds of separate condominiums, the reserve funds of separate condominiums, or all funds for investment purposes only.

In addition, Florida Administrative Code 61B-22.005(2) requires associations that collect operating and reserve assessments as a single payment to transfer the reserve portion of the payment to a separate account, or accounts, within 30 calendar days from the date the funds were deposited.

Commingling is important in the day-to-day management of association’s finances because it allows the association to fund Reserve Accounts and spend Reserve money without having to constantly move cash into and out of the Reserve Investment Account. Anytime that the Association’s Balance sheet shows money due to/from the Reserve Account, there is commingling of funds. This Asset/Liability entry is prevalent in most monthly financial reports.

Association Expenses

» Per FL Statute 617.0505: Common surplus of funds resulting from income exceeding expenses cannot be returned directly to unit owners. Excess funds can be:

-

- Credited towards the next year’s budget, or

- Allocated to the reserve accounts of the association.

» Association deficits (negative fund balances) need to be made up in the following year’s budget.

Multicondominium Association Accounting 101

Multicondominium association accounting requires all income and expense to be posted to the master community association or to the correct individual association. This is true for both Operating and Reserve accounts. Operating Accounts are used for day-to-day operation of the association, whereas master and individual condominium Reserve Accounts are required for capital expenditures and deferred maintenance.

Condominiums use Accrual Accounting, rather than Cash Basis, for tracking and recording income and expenses. This means that income exists when owner invoices are generated, and expenses exist when vendor bills are entered into the accounting software. At the end of each year an Annual Financial Statement Audit is conducted as required by Florida statutes. The Annual Audit reviews the accounting records and calculates cash balances for the Operating Account(s). Reserve Account balances are shown on a Reserve Schedule that is maintained monthly and presented to owners each year as a part of the Annual Budget.

Multicondominium associations need to perform a multicondominium audit each year to disclose operating fund balances for each individual association. Fund balance data can be used in one of two ways in preparing future budgets assuring that each association pays their fair share targeting for a zero fund balance (i.e., income = expense):

- Use current year budget performance data of each association's accounts to influence the new budgeted values -- i.e., charge them for the overage in the new budget, or

- Add a line item in the new budget charging or crediting the individual associations for the audited fund balance data.

Reserve Accounting

- Condominiums must have reserve accounts for Roof Replacement, Building Painting & Pavement Resurfacing.

- Reserve accounts are required for any item for which deferred maintenance expense or replacement cost exceeds $10,000.

- Reserve accounts must be fully funded at same frequency as assessment collections (i.e., quarterly).

- Use of Reserve funds for other than originally intended use requires owner approval.

- Membership has the right to annually vote to not fund reserves or to pool reserves. Pooled reserves do not require 100% funding of components.

- General or contingency reserves are not classified as reserves and must be in the operating budget.

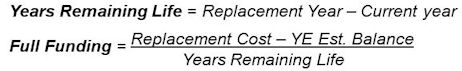

Reserve Calculations

» Replacement Cost is determined by actual prior expenditures (with an inflation adjustment), current vendor quotes or an engineering reserve study. Once established, the Replacement Cost may increase slightly due to inflation but would not change substantially from year to year.

| » Years of Life is determined by historical experience, vendor input and from experiences of other similar associations. The following Years of Life values are commonly used: | Asset | Yr. of Life | Asset | Yr. of Life |

| Paint | 7-9 | Roof | 18-22 | |

| Elevator | 28-35 | Spalling | 12-18 | |

| Pools | 10-15 | Paving | 18-24 |

» These are used to calculate Years Remaining Life and Full Funding:

The Mailbox Rule

There is frequently confusion or misinformation regarding the effective date of a document (legal notice, contract, check, etc.) that is sent via US mail. Specifically, associations need an accurate and consistent way of determining when a quarterly maintenance assessment payment is late. The actual effective date is based on the Mailbox Rule. The rule says that it's always the date mailed (i.e., the postmarked date) as shown in the following examples:

- Acceptance of a contract is effective when it is mailed.

- The effective date of a Claim of Lien or Foreclosure notice is defined by statute as the date of mailing.

- Florida courts have been clear about when owner assessment payments should be credited (when mailed, not when received).

Accurate annual budgets assure sufficient income to meet projected expenses. Monthly financial reporting provides tracking of expenses against budget. A published financial policy helps assure compliance with best accounting practices.

Accurate annual budgets assure sufficient income to meet projected expenses. Monthly financial reporting provides tracking of expenses against budget. A published financial policy helps assure compliance with best accounting practices.